In the last article Sue had a capital shortfall of $400,000 in order to support her desired retirement lifestyle. This amount will vary for each individual and will be larger or smaller depending upon your income, age and ability to save money as a percentage of your earned income.

Broadly speaking there are only two ways to build wealth or assets: by being a lender or an owner (having equity) of productive economic assets. In broad terms, this means that you will be allocating your savings to either fixed income type products ( ie. GICs ) where you lend your capital at interest to an institution, such as a bank, or to buying productive assets that create increasing cash flow over time.

Creating wealth or retirement assets can be achieved by using either of these two broad approaches. You can think of these approaches as the farmer and the rabbit approach to life. The farmer is careful with his money and stuffs any savings under the mattress because he doesn’t trusts banks a very conservative, loss adverse individual. The rabbit is the hot shot investor who has great confidence in her ability to ‘play the stock market’ and magically turn a modest amount of savings into a pot of gold!

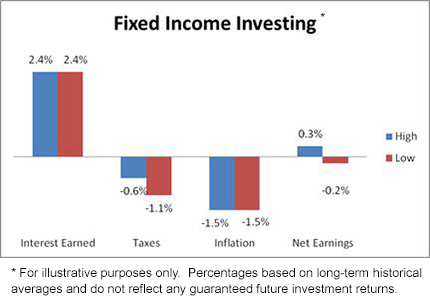

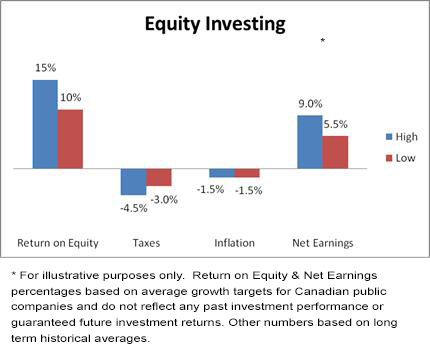

Let us compare these two broadly based approaches by reviewing some long-term historical trends. Here is what is involved with each of those broad categories:

What do these charts illustrate? If you invest in the fixed income category a dollar saved today may still be worth a dollar in purchasing power terms in 40 years (the assumed career of most people). Your ability to purchase a chocolate bar will remain the same throughout your life and hence maintain, but not improve, your current lifestyle. In order to create investment assets or savings of $500,000, such as in Sue’s case, you will actually need to save that amount from your earned income the sooner you start the better!

History shows that if you invest in equity (ownership) type assets the value of a dollar saved has the potential to grow over 40 years to meet your investment goals. This is a very important point to remember because it can make up for the lack of savings that Sue and other people experience as they attempt to create their assets from which to draw an income once they retire. It can also make up for a time horizon that is less than 40 years! The catch of course is being able to handle the daily ups and downs of public equity markets! We will address that in another article.

The reality for most people is that they will grow their assets through some combination of their savings and return on invested capital rather than just relying on one approach or the other. This is a very simple way to look at building assets by distilling down the great variety of investment options into two broad and basic categories: fixed income and equity investing.

Please call your Advisor today to discuss your specific situation, such as savings rate, years to retirement, risk tolerance, asset classes and health amongst other variables.

Questions about your asset strategies?

Contact our office!

Copyright © 2013 AdvisorNet Communications Inc., under license from W.F.I. All rights reserved. This article is provided for informational purposes only and is not intended to provide specific financial advice. It is strongly recommended that the reader seek qualified professional advice before making any financial decisions based on anything discussed in this article. This article is not to be copied or republished in any format for any reason without the written permission of the AdvisorNet Communications. The publisher does not guarantee the accuracy of the information and is not liable in any way for any error or omission.